A turbulent time for markets in Q1 2022..

Extra! Extra! Read all about it! Chaos in the markets with the S&P 500 crashing 38% and BTC crashing to 16k!

Did this heading trigger you? Yes

Are you prepared for such a scenario? No

Great this article is for you!

Let’s get one thing straight you do not have to take this trade and you alone are responsible for your own decisions. However you do owe it to both yourself and your portfolio to prepare for change should further cracks emerge.

“Even the intelligent investor is likely to need considerable willpower to keep from following the crowd" Benjamin Graham

Now lets begin looking at some of the damage that highly accommodative fiscal and monetary policies have caused. Looking at the concerning inverse correlation between the S&P 500 reaching new high’s and the majority of stocks heading below their 200 moving average leads me to believe that this move is going to be violent.

More concerning in the following chart everyone of the 15 times that the S&P 500 stocks above their 200 day average (blue line) falls below the highlighted red zone since 2007 a correction occurred within in S&P 500 which reliably called all of the major corrections in this period.

Now you can also observe that the every time it reached the top of the range it always has retraced into the red zone with haste signalling that this correction could be on the way sooner than everyone expects.

Looking back even further and looking into the dotcom bubble, breadth again declined steadily until March 2000 in which only one stock was left standing ‘Cisco Systems Inc’ which was the most valuable company in the world with a market capitalisation of more than $500bn. All it took was an earnings report and that was it for the dot-com bubble. Also worth noting that just two years after the dotcom bubble burst Cisco Systems Inc was now valued $51bn.

“We had a booming stock market in 1929 and then went into the world's greatest depression. We have a booming stock market in 1999. Will the bubble somehow burst, and then we enter depression? Well, some things are not different." Jeffery Sachs

Continuing on looking at the S&P 500 you will notice it is top of the Bollinger Bands range on the weekly and looks unlikely to go any higher and is overdue for a significant correction. On the monthly you could see it rise to 4950 although this would be a vertical move up and looks unlikely to me.

Let’s move onto the god father of risk assets.. BTC.

For those of you not familiar with my May 2021 BTC forecast I have included it below however I have new thoughts around how the next move plays out.

May 2021 forecast:

What actually played out and where we are now:

What my new thoughts are on BTC if we do get a major risk off event.

Now why do I think that we drop from $47,000 to $16,000? Because if I am right about the S&P having a significant correction I can assure you BTC will drop much faster and further.

Here is my map of how I expect this next down move to occur (the move from 90 to 30) however due to the wild actions of the FED I do not think this full chart will play out.

Although it would be a disservice to not outline the eerie similar manta that Owen Young and Michael Saylor share. RCA (radio’s) and BTC both share a common purpose of connecting the world although they are vastly different in other ways.

“It has helped to create a vast new audience of a magnitude which was never dreamed of… This audience, invisible but attentive, differs not only in size but in kind from any audience the world has ever known. It is in reality a linking-up of millions of homes.” Owen Young

With the US inflation rate rising to it’s highest level since 1982 at 6.8% and the FED still not taking any immediate action could this lead to an increased amount of blood covering the streets if they tackled inflation now?

“The most sinister of all taxes is the inflation tax and it is the most regressive. It hits the poor and the middle class. When you destroy a currency by creating money out of thin air to pay the bills, the value of the dollar goes down, and people get hit with a higher cost of living. It's the middle class that's being wiped out. It is most evil of all taxes.” Ron Paul

The gross federal debt is now 29 trillion and unfortunately the majority of this debt is classified as short term debt with an average maturity time of just 69 months. This makes it difficult for the FED to raise interest rates as then the majority of the future Federal budget would go to paying the interest on this debt and large cutbacks on Government programs would occur alongside tax increases would soon follow.

The current response to Omicron looks likely to further inflate wage inflation, supply chain bottlenecks, and goods inflation persisting into 2022. Looking at the situation from a political standpoint, inflation will be the biggest issue going into the midterm elections and aggressive tightening talk will soon pick up speed just enough to change market sentiment.

James Aiken from Aitken Investment Management otherwise known as the experts expert of the plumbing of the financial markets in a recent discussion on the 3rd of November 2021 made some interesting comments..

“The dichotomy here is if central banks are behind the curve, to some extent willingly because they want to see how long this persists, then it probably does mean somewhat fewer hikes in the near term”

“If central banks are wrong, it means a lot more hikes further out, which is not what the markets are pricing.”

“the market will have an epiphany that it is definitely behind the curve”

“they’re going have to tighten a lot more rapidly and go to a much higher level than the market is implying now”

Will the market have an epiphany soon and will you beat everyone else out of the door? Could markets drop and not even rise when the FED reverses policy?

“With such a massive build-up of private and public debt, markets may not be able to digest higher borrowing costs. If there is a tantrum, central banks would find themselves in a debt trap and probably would reverse course. That would make an upward shift in inflation expectations likely, with inflation becoming endemic.” Nouriel Roubini

The FED is now trapped and instead of kicking the can further down the road they are now forced to buy a new can every time they need it moved resulting in the raising price of can’s worldwide eroding consumer purchasing power.

Now lets look into some famous investors and see what they have to say about where what they think about the current state of inflation in 2021.

Billionaire Paul Tudor Jones has said earlier this year.

“I think to me the No. 1 issue facing Main Street investors is inflation, and it’s pretty clear to me that inflation is not transitory”

“It’s probably the single biggest threat to certainly financial markets and I think to society just in general”

“What they’re telling you by their actions, is that they’re going to be slow and late to fight inflation and somewhere down the road, somebody will have to come in ... and put the hammer down”

Stanley Drunkenmiller needs no introduction, he has built his wealth trying to look ahead how the world will look in 18months rather than the majority or investors who he believes live in the present. Stan believe’s that investors will continue to disregard looming signs of inflation and other market risks.

“I will be surprised if we’re not out of the stock market by the end of the year, just because bubbles can’t last that long” Stanley Drunkenmiller 2021

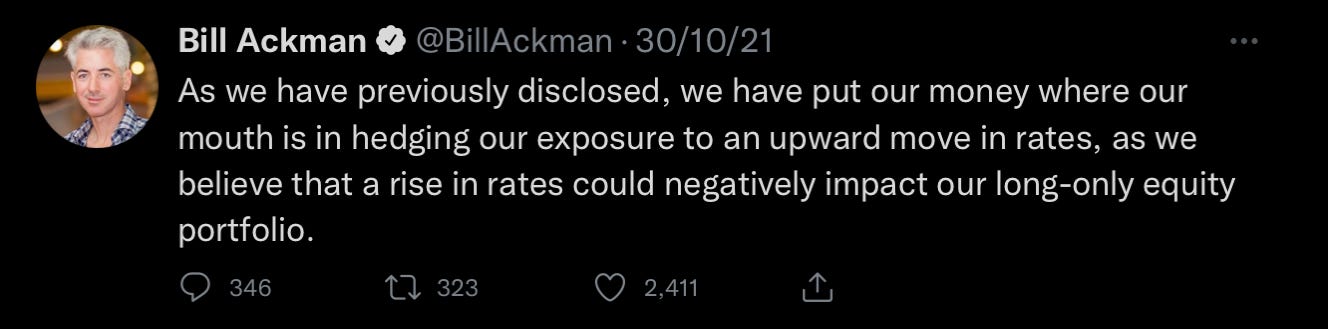

Bill Ackman a billionaire hedge fund manager recently gave a presentation to the New York Federal Reserve (joining Blackrock to have a say on US policy). Mr Ackman’s presentation outlined that the Fed should taper immediately and begin raising rates as soon as possible. Although you may catch Mr Ackman on twitter only tweeting bullish posts. Mr Ackman thinks that the fed is so far behind the curve and that one day they are going to have to raise the hammer and end QE from 100b to 0 and raise the funds rate.

Here is Mr Ackman’s only bearish post from two months ago.

Billionaire Hedge fund manager David Tepper has also turned somewhat bearish on the stock market, citing uncertainties around interest rates and inflation.

“I don’t think it’s a great investment right here”

“I just don’t know how interest rates are going to behave next year... I don’t think there’s any great asset classes right now... I don’t love stocks. I don’t love bonds. I don’t love junk bonds”

“Meme investing, the idea that something is worth investing in, or rather gambling on, simply because it is funny has become commonplace. It’s a totally nihilistic parody of actual investing. This is it guys, the biggest U.S. fantasy trip of all time.” Jeremy Grantham

What do the Fed have to say about all of this in 2021 and are you sure they have your back?

Fed Chairman Jerome Powell has been asked repeatedly about whether they’re concerned over rising stock prices. Powell specifically has said that as long as interest rates stay low, the valuations are justified.

Does this mean that valuations are no longer justified if Mr Powell is trying to raise interest rates?

In a 2021 FED Financial Stability Report, it notes that there’s danger lurking should market sentiment change. The report states:

“High asset prices in part reflect the continued low level of Treasury yields. However, valuations for some assets are elevated relative to historical norms even when using measures that account for Treasury yields”

“In this setting, asset prices may be vulnerable to significant declines should risk appetite fall”

Accompanying the Financial Stability Report Fed Governor Lael Brainard made a statement..

“Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year”

“The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event”

A survey the Fed conducted across a variety of 24 market contacts showed that the biggest worry is virus related, specifically focusing on vaccine-resistant variants which was followed by a sharp increase in interest rates, a surge in inflation, and tensions between the U.S. and China.

Now you must ask yourself do you have a plan when the wind changes and like everyone else will you wait for the wind to change before acting?

“They are dancing in a room in which the clocks have no hands"

Warren Buffett

Stay tuned for my next piece that focuses on Russia and Ukraine and keep an eye out for Joe Biden’s next meeting with Russia's Vladimir Putin early this month.

Disclaimer: I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor. All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice.

That BTC call was out of this world O_O

Man, I'm in love with your work. I simply don't know how you have been hitting a homerun after a homerun. Unfortunately there's no more posts in here. Your material is pure alpha and if I could ask you something would be to please continue to write it. I really wish I had 5% of your foresight.